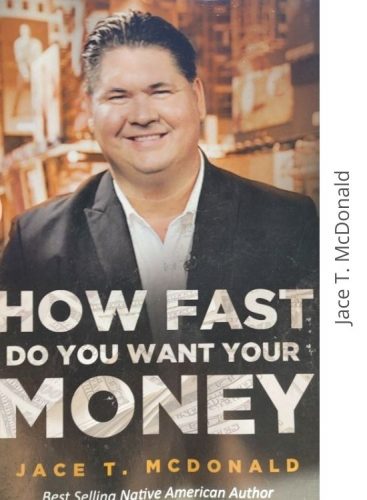

Jace McDonald, is a Native American successful entrepreneur, bestselling author, and profit enhancement, consultant.

He has built his empire with his philanthropic work and clean monetary profit.

Recently Jace T. Mcdonald and his team were selected by Legion Capital Precedent, Bradley Hilton to be working with Legion Capital LLC and Legion Funding LLC for helping others with financial success.

Jace T. Mcdonald has helped the Native Americans by creating new jobs as well as entrepreneurial opportunities for people across the country.

He is the co-author of the Soul of Success Vol. 2.

Being a consultant and a self-employed business owner taught him the nitty-gritty things of an entrepreneur’s life. This gave him the understanding and courage to take up something entirely new in his life by aiming to help small, hard-working business owners, with the invaluable knowledge of alternative wealth products. This work of his has given a whole new meaning to the word ‘social entrepreneurship’.

He has written a new book “How Fast do You Want Your Money”.

About “How fast do You Want Your Money”

CARES ACT was passed by Congress on 27th March. Jace Mcdonald has explained in his book how it helps your business.

New lucrative TAX code changes for your business, due to CARES ACT.

As a business owner, you are busy and hire professionals to handle your very important CPA and tax professional work.

Those professionals have had over 3,000 changes hit them since the last government administration left office and the new current administration has been in place.

More changes have occurred, such as the tax code changes in the JOBS ACT and then the current CARES ACT. Are you aware of the new lucrative tax code changes?

Very few services are working with your CPA to help guide you through the process. This will see if you qualify under the Expanded R n D credits that many professionals never knew

They would or could benefit from, such as Dentists, Farmers, Manufacturing.

IF your business owns commercial real estate, new guidelines have opened up and expanded within the CARES ACT to make the more lucrative time in the tax code.

Is your tax person a tax CREDIT, tax incentives, and tax savings specialist? That’s ok the team offering the fastest turnaround to meet the CARES ACT deadlines is offering FREE analysis,

No upfront money to see how much you qualify for. One dentist just qualified for $134,000 another Metal Fab show over $1.5 million in overall benefits, their CPA missed the first 15 years they

Have been in business. What about a $269,900 tax wipes out for this year, WOW yes WOW that’s what the owner’s wife said. A true blessing to their business family-run for almost 20 years.

Please take time to see if your business qualifies for tax-free money from the CARES ACT you have nothing to lose, any state you work in or own real estate in qualifies.

How soon could you use your tax-free money? What if in 3 to 5 days your free analysis is ready for a review with a tax credit specialist are you ready to find out how much tax-free money you deserve to take advantage of?

Free Consultation

Feel free to call the hotline 608 403 7008 tax credit hotline or text 608 516 1956 and speak with a professional.

FREE ebook Howfastdoyouwantyourmoney.com for your free copy. Learn more about this huge tax-free money distribution that your business

Is missing out on. This is not a loan, this is not an SBA program, this is tax incentives and credits that you are not getting at your business that are being missed that

You may qualify under the new CARES ACT guidelines.

End Words

Jace T. McDonald is a successful social entrepreneur and author. He has a lot of contributions to society. You should read your books to boost up your business and income.

Read Other Articles

Pingback: Tabaz Noori – An Untold Story | OS Digital World